Smart Taxes: Roth IRA vs. Traditional IRA Decisions

Without fail as Tax Day approaches every year, the mind whirls while you check boxes and fill in numbers about everything you could have, should have, would have done to save more money on taxes. Could you have saved more? Invested better? Been smarter at charitable giving? Probably. It’s too late for some money-saving measures in the last minute lead up to the deadline for filing your taxes, but one you can take on simple measure to maximize your tax advantages (perhaps now, and certainly later)—set up a Roth IRA account.

IRA 101

First off, what even is an Individual Retirement Account (IRA)? Other than that retirement account you have through work an IRA is something you can set-up for yourself. An IRA is just a savings account that specially designed to help you save for retirement with specific tax advantages. There are two types of IRAs: Traditional and Roth.

Roth IRA

What’s so special about a Roth IRA? Compared to a traditional IRA, you can contribute at any age if your modified adjusted gross income (AGI) is below a certain limit and you have taxable compensation. It’s subject to just as many rules as a traditional IRA, with the exception of some substantial different ones. Among others you can leave Roth IRA money in the account for life; you’re not required to begin taking distributions from your Roth IRA at any particular age. Plus, qualified withdrawals are tax-free.

Another clear benefit is tax-free compounding. Capital gains—money you’ve contributed that then makes more money through investments—will be avoid being taxed each year as they grow until they’re distributed. The same goes for dividends. (This is a major benefit as the IRS doesn’t see other non-retirement related investments in this way.)

So, What’s the Tax Advantage?

If Roth IRA contributions are not tax deductible, what’s the benefit? Ultimately the tax benefits are going to be in the long-term.

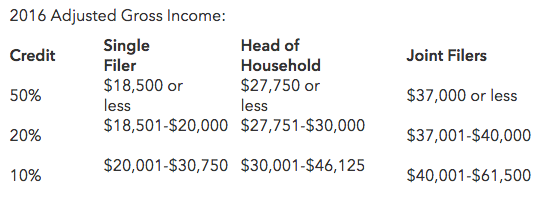

There’s a great immediate benefit for some people to get a Roth IRA before filing. If you qualify you can claim a tax credit (the Saver’s Tax Credit) of up to 50 percent of your first $2,000 contributions on IRS Form 8880. Here’s a table of the maximum credit one could take in relation to their 2016 AGI.

Table for 2016, Turbotax.com

The tax-free withdrawals protect you from income tax raises. When you retire you may be in a higher tax bracket then you are today, so it makes sense to delay the major tax benefit upfront and shift it to retirement age. Ultimately the Roth IRA can help protect you from paying higher taxes in the future.

Not a tax-specific benefit, but a benefit all the same is that contributions can be withdrawn at any time unlike other retirement accounts. Say you’ve contributed $1,000 annually for 10 years and then have an emergency in which you need the funds. You could withdraw $10,000, just not the investment gains off of the investment.

Contribution Limits

Through the year (2017) your total contributions to all IRA accounts (traditional and Roth) combined cannot be more than $5,500 or $6,500 if you’re age 50 or older.

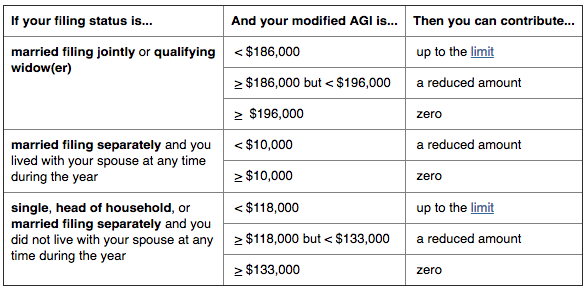

For a Roth IRA there’s a whole other table that delineates who can and cannot contribute. Let’s say you’re married and filing jointly. If your modified AGI is greater than or equal to $196,000 you can’t contribute anything. If you and your partner’s modified AGI is less than $196,000 but greater than $186,000 you can only contribute a reduced amount. Only those couples with a modified AGI less that $186,000 can contribute up to the limit.

Table for 2017, irs.gov

What About Other Retirement Plans?

A Traditional IRA can offer tax benefits, but the window for those who qualify for the deduction is limited.

Depending on your IRA set-up you’ll either deduct the contribution from your taxes on the current tax year or do so after you turn 59 and a half. (Whatever you do, don’t pull the money back out until after you are age 59 and a half.)

If you (or your spouse) is covered by a retirement plan at work, you’ll be able to take a full deduction up to the amount of your contribution limit if the modified AGI is $98,000 or less. AGI equaling more than $99,000 and less than $119,000 can take a partial deduction.

Table for 2017, irs.gov

As you could guess the table figures look different if you’re not covered by a retirement plan at work. Then of course things get even more complicated if one spouse is covered by a work plan and the other isn’t.

Table for 2017, irs.gov

Luckily, you don’t have to pick just one IRA to contribute to. You could split your money between multiple different accounts.

A few of the critical issues to compare Roth and Traditional IRAs include:

- The tax equivalency principle which means that the starting point is to focus on current versus future tax rates.

- Pay the tax when the tax rate is anticipated to be the lowest.

- Avoid Required Minimum Distributions (RMDs) allows for slightly lower future tax rate to favor Roth IRAs.

- There may be an estate tax impact on which IRA to hold. It’s specific to client’s facts and circumstances.

Expert Advice

Because IRAs can be complicated, especially when it comes to how much you can contribute, who can deduct what, and when you can utilize the money it’s important to talk to a trusted financial advisor. They’ll best be able to point you in the right direction given your personal financial goals.

Resources

- https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2017

- https://turbotax.intuit.com/tax-tools/tax-tips/Taxes-101/What-Is-The-Savers-Credit-/INF15617.html

- https://www.irs.gov/retirement-plans/traditional-and-roth-iras

- https://www.tesswicks.com/blog/setupanirawithbetterment

- https://www.fool.com/retirement/iras/2015/08/04/the-5-best-roth-ira-benefits.aspx

- http://www.rothira.com/what-is-a-roth-ira

- https://investor.vanguard.com/ira/roth-ira

- http://www.rothira.com/traditional-ira-vs-roth-ira

- http://money.cnn.com/retirement/guide/IRA_Roth.moneymag/index7.htm

- http://www.rothira.com/blog/hacking-retirement-the-unique-tax-benefits-of-roth-iras

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2014-2017 Advisor Websites.